Fixed income households preparing to or in retirement require a great deal of budgeting and cash flow management. Creating a plan is easy; deploying your plan requires discipline and persistence to meet, obtain, and fulfill your retirement dreams. Our goal is to maximize the value of your retirement dollars while minimizing the effort to maintain monthly obligations and prepare for changes in cash flow due to [potential] future events.

Preparing to Retire:

Households nearing retirement need to know what their options are when contemplating housing costs, investment security, income streams, and tax issues. To develop a plan is complex and requires sounds advice. Money Mentor will provide analysis of your current situation and suggest possible paths to retirement that will maximize the value of your savings (and savings possibilities), while providing you with various options on how to reduce and automate your expenses making the management of your plan easy to track.

Entering Retirement:

You have saved all of your life. You are ready to retire, but have questions about how you can make your retirement savings last? Use Money Mentor to analyze your current income and expense and predict cash flow issues and potential shortages. Compare your plan to our suggested plan to see how you might make minor changes to prolong the value of your retirement dollars.

Automation: Maintaining Your Obligations during Retirement:

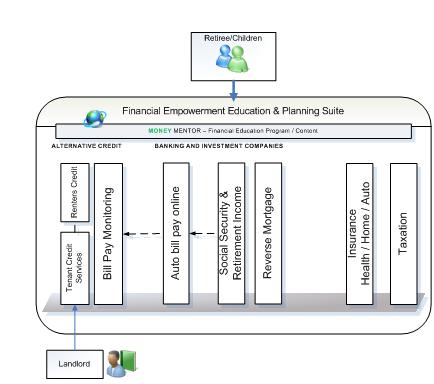

Money Mentor allows retires and family members to prepare and manage a retirement plan work from one simple application. Once the plan is in place, all participant users can login to our secure site, set up or view recurring payments, monitor cash flows, and project annual income needs based on real information. This simplifies the management of monthly income and expenses for both the retirees as well as the children who provide help and support to the household.