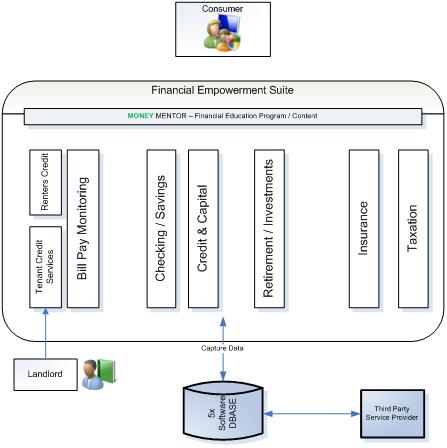

While Money Mentor is a consumer centric program, there are many opportunities for banking, real estate, and the general financial services industry. Here is a macro view of the vertical channels in the Financial Empowerment Suite ("FES").

Money Mentor can provide solutions to legislative and policy issues:

Since the inception of the financial/Mortgage/Banking crisis, many new regulations have passed with more being contemplated that require business to provide or support financial [literacy] education. Money Mentor will work with business to provide the affective solutions that (a) do not place restrictions on current business processes and , (b) have effective measurable results.

Money Mentor creates informed responsible consumers:

CIE will develop the Money Mentor program to support multiple market segments including;

Money Mentor users will become more informed consumers through education and tracking their financial goals. Clients that can manage and fulfill their financial responsibilities are low risk clients that any financial institution will welcome as a customer.

Scalability:

Money Mentor is a highly sophisticated, 21st century web 3.0 application that, unlike conventional models, can scale to the demand of the market. The market segments that we cater to demand quick, easy, online solutions to their day-to-day needs. Money Mentor will provide a one stop shop for all financial education and management. Coupled with the right mix of partners, users will be able to learn about, comparison shop, purchase, and automate the management of all of their personal finances.

Relevance:

With the ever changing landscape of finance and technology, CIE will continue to update the Money Mentor system based on CISE research data.

Partners:

CIE is looking for the right strategic partners to further its mission. The Financial Empowerment Suite will require services from every financial discipline. Contact us if you are interested in discussing how your business can be a trusted advisor / partner with Money Mentor.